The former president has long history of complaining about Mr. Powell and the Fed.

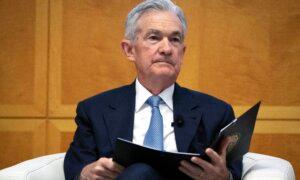

Federal Reserve Chair Jerome Powell will not be reappointed to a third term as head of the U.S. central bank, says former President Donald Trump.

“I think he’s political,” President Trump said to host Maria Bartiromo. “I think he’s going to do something to probably help the Democrats, I think, if he lowers interest rates.”

President Trump warned that the U.S. economy could face the possibility of witnessing an inflation resurgence, citing chaos in the Middle East that would lead to “tremendous spikes in the price of oil.”

“And if you do that, you’re going to have big inflation,” the real estate billionaire mogul added. “He’s not going to be able to do anything. But it looks to me like he’s trying to lower interest rates for the sake of maybe getting people elected.”

He stopped short of saying who he would select to lead the Fed.

“I would have a couple of choices. I can’t tell you now,” the former president noted.

This is not the first time that he has hammered Mr. Powell.

This past summer, the GOP frontrunner told Fox Business Network’s Larry Kudlow that he would not reappoint him.

“I thought he was always late, whether it was good or bad, but he was always late,” President Trump said in August. “I was surprised he was reappointed. Probably, he got reappointed because they knew I didn’t like him much. I’m not a fan of Jay Powell.”

In a March 2023 interview, he also conceded that he “was not a big fan of Powell,” telling Fox News host Sean Hannity that “he was recommended by some people.”

“I didn’t like him, he’s too interest rate happy.”

In Nov. 2017, the 45th president tapped Mr. Powell to head the central bank. In 2021, President Joe Biden nominated him to a second term.

When asked by reporters during the post-Federal Open Market Committee (FOMC) press conference on Jan. 31 if he would serve a third term, Mr. Powell refused to comment. He stated that he is focused on the tasks at hand, namely price stability and maximum employment.

Staunch Fed Critic

President Trump routinely railed against the Federal Reserve and Mr. Powell during his time in the White House.

In June 2019, he called the central bank a “stubborn child” because it refused to cut interest rates.

Two months later, President Trump mocked the Fed chair for raising interest rates and vowing to not bow down to political pressure.

“We have a man that doesn’t do anything for us,” President Trump told the Fox Business Network. “So now he’s trying to prove how tough he is because ‘he’s not gonna get pushed around.’ Here’s a guy — nobody ever heard of him before, and now, I made him, and he wants to show how tough he is.”

Even after pulling the trigger on rate cuts, President Trump still targeted monetary policymakers, arguing on X that “people are very disappointed in” Mr. Powell and that “China is not our problem, the Federal Reserve is!”

Biden, Powell, and Democrats

President Biden has remarked very little on the Federal Reserve, conveying that he would respect the organization’s independence.

However, President Biden encouraged the Fed to stop raising interest rates at a December event because of solid economic data. Days following these comments, Mr. Powell and rate-setting Committee members signaled three rate cuts in 2024 and two more in 2025.

Democratic lawmakers have been more forthright in their calls to action.

Last month, Sen. Elizabeth Warren (D-Mass.) and three other Democratic senators urged the Fed to cut rates as soon as possible to grapple with housing affordability.

“Powell should cut interest rates now given most of inflation was caused by supply shocks,” Mr. Khanna stated on X. “If he doesn’t, he may be the person most responsible for the possible return of Trump.”

Since March 2022, the Federal Reserve has raised the benchmark Fed funds rate 11 times to a more than two-decade high as part of efforts to clamp down on rampant price inflation. After nearly two years, the annual growth rate of inflation has slowed while keeping the U.S. economy and labor market intact.

At the January policy meeting, the Fed left rates unchanged at a range of 5.25 percent and 5.50 percent.

While the White House claims the economy has achieved a soft landing, Mr. Powell stated at a recent post-FOMC presser that it would be premature to declare victory despite healthy economic conditions.

Original News Source Link – Epoch Times

Running For Office? Conservative Campaign Consulting – Election Day Strategies!