Monday’s dramatic bond reduction for former President Donald Trump did nothing to dissipate the dark cloud that his civil-fraud case has cast over New York business deals.

Although investors won’t publicly admit it, the case is having a chilling effect, said Charles Trzcinka, professor of finance at Indiana University-Bloomington.

“If you talk to people in this market, they are very, very upset … and these are people who are neutral or even opposed to Trump,” Mr. Trzcinka told The Epoch Times. “They’re just angry about it.”

In his role at the university, Mr. Trzcinka said he places students in the corporate lending market in New York, making him aware of trends in that sphere.

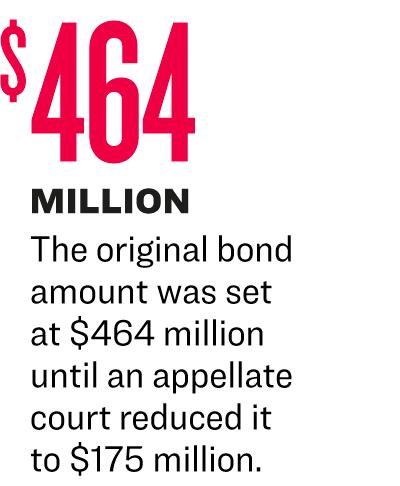

An appeals court’s decision to slash the bond by about 60 percent, reducing it to $175 million, still left a massive penalty intact while President Trump continues a legal challenge of Justice Arthur Engoron’s ruling.

Judge Engoron ruled that President Trump and his associates fraudulently overvalued their assets. But Mr. Trzcinka said anyone who thinks President Trump’s activities in that case were irregular or fraudulent may lack an understanding of typical New York business transactions.

A source familiar with the case explained to The Epoch Times that, normally, business-related cases are handled in the New York courts’ commercial division.

There, cases are decided by judges who have specific, “sophisticated” knowledge of commercial law and business practices.

But the case didn’t go that route because New York Attorney General Letitia James found a novel way to use New York’s anti-fraud law.

Because of Ms. James’ unusual application of the law, the case was channeled to a court that would rarely, if ever, handle business-related matters.

Thus, the source said, “This case proceeded in just a highly irregular fashion from the start.”

The New York Stock Exchange on Wall Street in New York on March 20, 2024. (Charly Triballeau/AFP via Getty Images)

‘A Degree of Horror’

Legal scholar Jonathan Turley agreed the case is atypical and its repercussions far-reaching.

However, people who dislike President Trump are cheering on Ms. James. She ran for election on a promise to prosecute the former president if she won the post of attorney general.

Before the court-ordered bond reduction, the original $464 million bond amount included a $363 million judgment that Judge Engoron levied against President Trump and his associates, plus 9 percent interest.

Speaking to reporters after the March 25 appellate court’s decision, President Trump called Judge Engoron’s original decision a “disservice” to New York.

“Businesses are fleeing,” he said.

The case promises to continue discouraging investors from doing business in the Empire State, Mr. Trzcinka and two other knowledgeable sources told The Epoch Times.

That’s not only because of the crippling dollar amounts involved, the sources said, but also because President Trump and his associates were behaving within the bounds of normal business practice and victimized no one.

“All the parties under this civil case were satisfied,” Mr. Trzcinka said. Yet Ms. James “brought a case without a victim” and secured a judgment approaching $500 million.

“I have never heard of a victimless civil case that even won $500,” he said.

(Top L) Former President Donald Trump speaks to the media during a pre-trial hearing in New York City on March 25, 2024. (Top R) New York Attorney General Letitia James (C) watches the start of former Presdient Donald Trump’s civil fraud trial in New York City on Oct. 2, 2023. (Bottom) People enter New York Supreme Court on Jan. 11, 2024. (Brendan McDermid-Pool/Getty Images, Spencer Platt/Getty Images)

Silently Worrying

Businesspeople are afraid to express concerns about the ramifications aloud. Doing so would paint targets on their backs—an underlying reason why President Trump was unable to persuade bonding companies or banks to cover the original $464 million bond, Mr. Trzcinka and the sources said.

“I don’t think a bonding company [or a bank] is willing to be associated with Donald Trump … because the attorney general could turn around and sue them, go after them,” Mr. Trzcinka said.

Judge Engoron ruled that President Trump and his associates committed fraud by overvaluing his properties.

Parties involved in real estate transactions tend to exaggerate values in one way or the other, and they “hit each other over the head” with dueling appraisals, Mr. Trzcinka said.

And, in a case such as this one, “everyone had the same information and just came to different conclusions” as to the valuations, he said. Then the parties negotiated figures and agreed to them.

Unaffordable for a Multi-Billionaire?

Even before interest was added, Judge Engoron slapped President Trump with “the largest penalty in history” for a case of its kind, said Mr. Trzcinka.

He had never heard of such a high penalty imposed for a “syndicated loan,” which involves civil contracts between a corporate borrower and corporate lenders.

About $355 million of the total order specifically applied to President Trump. In addition, the judge ordered $4 million to be recovered from each of his sons, Eric Trump and Donald Trump Jr., and $1 million from former Trump Organization finance chief Allen Weisselberg.

Even the ultra-wealthy would rarely, if ever, have rapid access to hundreds of thousands of dollars in liquid assets, Mr. Trzcinka and other financial experts say.

Marshaling that much cash to post the bond in just 30 days proved to be a daunting task for President Trump; the appellate court’s ruling granted him 10 more days to post a reduced $175 million bond.

That decision moved the amount from “the realm of the impossible” into a different category; “it’s expensive but it’s feasible,” a source said.

A number of bonding companies said that the most they could shoulder would be $100 million, President Trump’s lawyers said in court filings, adding that many people worked countless hours to find possible solutions to the former president’s predicament.

Judge Arthur Engoron attends closing arguments in the Trump Organization civil fraud trial in New York City on Jan. 11, 2024. (Shannon Stapleton/POOL/AFP via Getty Images)

Not Like a Parking Ticket

A Trump insider said it was patently unfair to pressure President Trump to materialize those funds so fast.

“This timeframe is insane,” said the insider, who spoke to The Epoch Times on condition of anonymity. “I’ve been given more time to pay a parking ticket in New York City than Donald Trump has been given to pay a $500 million bond.”

In contrast, officials granted President Trump less than one-third that amount of time to fulfill the bond requirement of nearly a half-billion dollars.

On March 22, the former president announced that he had secured almost $500 million in cash. That was just three days before a deadline that authorities set for the bond to be posted. In a post on his Truth Social account, he strongly implied he might use that money to cover the bond.

On March 25, after the appeals court reduced the bond to $175 million, a reporter shouted a question, asking what collateral he would use for that bond. President Trump replied, “cash.”

President Trump did not disclose the specific sources of the money but said he was planning to use a significant portion of the amassed $500 million toward his 2024 presidential campaign.

‘Devalued’ NY Property

President Trump also pointed out that, because of financial disclosure laws, Judge Engoron was aware of how much money he had available.

In a social media post, President Trump alleged Judge Engoron set the penalty to correspond with his disclosed amount of funds.

Citing the very specific dollar amounts listed in the judgment, Mr. Trzcinka said it almost seemed as though the figures came from “a random number-generator.”

(Top) A person walks past the Trump building on Wall Street in New York City on Feb. 17, 2021. (Bottom) The Williamsburg Bridge (top) and the Manhattan Bridge span the East River in New York City on Feb. 12, 2024. (Angela Weiss/AFP via Getty Images, Charly Triballeau/AFP via Getty Images)

In court records, Judge Engoron said he based his decision on the testimony of an expert who calculated how much the defendants benefited from “ill-gotten interest rate savings” resulting from the inflated value of assets.

President Trump is the Republican Party’s presumptive nominee to oppose the Democrats’ apparent nominee, President Joe Biden, in the November general election.

President Biden and others have denied political motivations. However, recent evidence has surfaced showing contact between some prosecutors and the White House prior to President Trump’s indictments.

If President Trump failed to meet the previous 30-day, $464-million bond deadline, Ms. James was poised to begin seizing his assets.

Other businesspeople are looking at this situation, Mr. Trzcinka said, and asking themselves: “If they can do this to Trump, what’s going to happen to me?”

If the penalty assessed had been $10 million or less, the case would be far less worrisome. But with the amount exceeding $300 million, “it just crushes the big market,” he said.

Investors have always had to consider cashflow risks and the risk of people filing lawsuits. Because of the Trump case, the risk of adverse government action has just increased exponentially, Mr. Trzcinka said, adding, “as soon as risk goes up, investments go down.”

As a result, the case has “devalued the property in New York City,” he said. “This now is a huge problem for them, and it came out of the blue.”

Michael Washburn contributed to this report.

Original News Source Link – Epoch Times

Running For Office? Conservative Campaign Consulting – Election Day Strategies!