Remark comes in response to Office of Management and Budget director’s view of ‘a strong economic recovery’ and jobs growth.

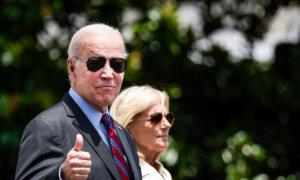

The Biden administration’s rosy depiction of the U.S. economy is not going to fool the public, Rep. Tom McClintock (R-Calif.) told the White House’s budget director on March 21.

The exchange came at a House Budget Committee hearing as Office of Management and Budget Director Shalanda Young testified about President Joe Biden’s proposed budget for fiscal year 2025.

In her opening statement, Ms. Young touted the president’s oversight of “a strong economic recovery,” including the creation of 15 million jobs and an unemployment rate that has remained below 4 percent for two years.

But that optimistic view of the situation did not sit well with Mr. McClintock.

“Madam director, as I listen to you and my Democratic colleagues, I just wonder if you’re ever going to learn that you cannot spin the economy,” he said. “Everybody knows, in their own lives, how they’re doing. And if you try to spin them, you just end up looking foolish and out of touch.”

The California lawmaker noted that many of the jobs that had been created were part-time positions being filled by illegal immigrants the president had deliberately allowed into the country.

“By flooding the market with cheap illegal labor, you’re killing the wages of American working families,” he said.

The ‘Misery’ of Socialism

The president unveiled his fiscal year 2025 budget earlier this month. His plan calls for $7.3 trillion in spending and significant tax hikes on corporations and those earning more than $100 million.

Highlighting the corporate tax increase, Mr. McClintock said the change from 21 to 28 percent would end up harming middle-income employees and consumers.

“There are only three possible ways that a corporate tax can be paid,” he said. “It’s paid by employees through lower wages, it’s paid by consumers through higher prices, and it’s paid by investors through lower earnings—that’s your 401K. I don’t know of any other way a corporate tax can be paid, do you?”

Ms. Young suggested that corporations could halt stock buyback programs to pay the tax.

“But that’s not true,” Mr. McClintock said. “That comes directly out of their earnings that they use to pay their employees, the earnings that they use to keep prices down in a competitive market, and the earnings that they pay to investors, which are people’s retirement funds.”

Another policy the congressman took Ms. Young to task for was the administration’s decision to cancel billions in student loan debt at the expense of American taxpayers.

“You’ve now required taxpayers to pay off $132 billion in loans from college students. How much more are you proposing?” he asked.

“The president has been unapologetic in saying that we need to do whatever we can to reduce the burden that student loans have had for students,” Ms. Young replied.

“But I think he should be very apologetic in this respect,” Mr. McClintock shot back, questioning how it could be fair to expect a truck driver to pay off a college graduate’s loans.

The director countered that there were truck drivers with student loan debt, too, who were benefiting from the program.

But Mr. McClintock stressed that when the government takes money from consumers, it reduces not only what they can provide for their families but also their incentive to produce goods and services for others. “That’s why socialism produces misery and poverty wherever it’s imposed on society,” he said.

Economic Forecast

The hearing comes a day after the nonpartisan Congressional Budget Office (CBO) released its annual long-term budget and economic outlook.

Over the 30-year span, budget deficits are expected to average 6.7 percent of GDP—3 percent more than they averaged over the last 50 years. In 2054, the total deficit is projected to be 8.5 percent.

Near-term projections place the debt at 107 percent of GDP by 2029, exceeding its historic post-World War II peak and continuing to climb from there.

The CBO attributed the change to its expectation of “stronger growth of the potential labor force over the next 10 years, largely driven by increased net immigration and faster capital accumulation over the next 30 years.”

The agency also cited last year’s debt limit deal, the Fiscal Responsibility Act, as another reason for the improved projection. The law suspended the statutory debt limit through January 2025 in exchange for discretionary spending limits over the next two years.

Emel Akan, Jackson Richman, Andrew Thornebrooke, and The Associated Press contributed to this report.

Original News Source Link – Epoch Times

Running For Office? Conservative Campaign Consulting – Election Day Strategies!