National debt is poised to reach $36 trillion soon.

The federal government plans to borrow $1.369 trillion over the next six months, the U.S. Department of Treasury announced on Oct. 28.

Washington borrowed $762 billion from July to September, which was $22 billion more than projected.

In the January to March quarter, the Treasury then plans to borrow $823 billion, assuming an end-of-March cash balance of $850 billion. This three-month period potentially coincides with another round of debt-ceiling negotiations and expectations that Congress will raise or re-suspend the debt limit.

If forecasts are accurate, the first-quarter 2025 borrowing would represent the largest nominal amount for this period.

The government’s latest projections were released ahead of its quarterly refunding announcement on Oct. 30, in which the Treasury Department will outline its plans for long-term debt issuance.

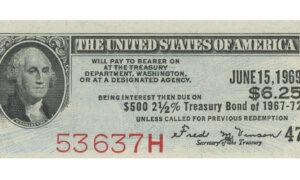

In recent years, the U.S. government has issued trillions in short-term debt securities—bonds that mature from 30 days to 1 year—to manage higher interest payments and growing budget deficits.

The federal shortfall was $1.83 trillion for fiscal year 2024—the third-highest on record.

Private-sector estimates suggest that Treasury bills will represent 40 percent of net Treasury issuance.

However, while it had been expected that the Fed’s reduction in interest rates would result in lower U.S. government bond yields, the Treasury market has rocketed over the past month.

It was a classical case of “buy the rumor, sell the news,” says Adam Turnquist, the chief technical strategist at LPL Financial.

“Investors priced in lofty rate cut expectations ahead of the highly anticipated September Federal Open Market Committee (FOMC) meeting,” said Turnquist in a note. “And even though the Federal Reserve delivered a 0.50 percent interest rate reduction, investors sold the news, sending Treasury yields notably higher. In fact, 10-year yields are now up over 0.50 percent since the September 18 rate cut.

Federal Reserve Chairman Jerome Powell’s speech is seen on a television screen as traders work on the New York Stock Exchange floor during morning trading on Aug. 25, 2023. Michael M. Santiago/Getty Images

Fed Chair Jerome Powell has suggested that he and his colleagues can take it slow on the way down to lower rates.

$36 Trillion Milestone Incoming

According to Treasury data, the national debt topped $35.8 trillion on Oct. 24, three months after reaching the $35 trillion milestone.

The national debt has surged $1.2 trillion since the beginning of the year.

In its latest October Fiscal Monitor, the International Monetary Fund (IMF) stated that increasing U.S. debt and deficit levels have a “low probability of stabilizing by 2029.”

IMF economists predict that the budget deficit will stay above 6 percent of gross domestic product until at least 2029. Additionally, their short-term outlooks were also revised higher, with the deficit anticipated to be 7.3 percent of gross domestic product in 2025, up from the previous forecast of 7.1 percent.

“Under current policies, the US public debt is not stabilized, reaching almost 134 percent of GDP in 2029,” the IMF concluded.

Neither presidential candidate this election cycle has presented a plan to address the national debt, says Mark Malek, the CIO at Siebert Financial.

“In reality, and we have history as our guide, the spending will more likely not be paid for and the overall deficit will increase. How will those expenditures be paid for? Of course, through increased borrowing,” Malek said in a note viewed by The Epoch Times.

Original News Source Link – Epoch Times

Running For Office? Conservative Campaign Consulting – Election Day Strategies!